Contents

Fha Va Loan Requirements For information on FHA and VA loans, click here. For more about the BBVA Compass HOME program, click here. All loans subject to program eligibility, collateral and underwriting requirements and.

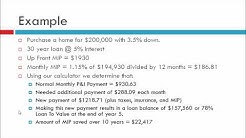

· In addition to the upfront mortgage insurance premium, the FHA charges annual mortgage insurance. The FHA charges the lender that holds your loan the premium once a year. But the lender will divide that fee up amongst the 12 monthly payments you make on your mortgage payment.

Upfront mortgage insurance premium (MIP) is required for most of the FHA’s Single Family mortgage insurance programs. lenders must remit upfront MIP within 10 calendar days of the mortgage closing or disbursement date, whichever is later.

. insurance (MIP) costs have risen to dizzying heights in the last few years, consumers in this market segment stepped back to assemble more down payment and qualifying virtues to secure.

Unfortunately, most FHA refinancing loans will require you to make an upfront mortgage insurance payment. In accounting parlance, this is known as a UFMIP.

Upfront mortgage insurance premium (MIP) is required for most of the FHA’s Single Family mortgage insurance programs. Lenders must remit upfront MIP within 10 calendar days of the mortgage closing or disbursement date, whichever is later.

As if the high up-front and monthly mortgage insurance premiums weren’t enough, the federal housing administration has been systematically overcharging borrowers at the closing table when they.

As if the high up-front and monthly mortgage insurance premiums weren’t enough, the federal housing administration has been systematically overcharging borrowers at the closing table when they.

Cabalsi was able to earn the deal by extending his lender credit to pay all fees and also the FHA up-front mortgage insurance premium. For this particular loan, the FHA mandatory premium was 1.75.

FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, and a monthly cost, included in your monthly payment.

Upfront Mortgage Insurance Premiums. The first insurance cost that borrowers face is an upfront mortgage insurance premium. This “MIP” is a flat 2% premium based on the amount the maximum lending limit of $726,525 or your home’s appraised value,

Fha Upfront Mip Chart – Lake Water Real Estate – FHA upfront . The ) is a fee that’s charged to the borrowers up front for all FHA purchase loans, cash-out refinances and rate-term refinances that aren’t streamline loans.

Fha Home Requirements 2016 The old fha loan policy for student loan debt "required Mortgagees to calculate a monthly payment for deferred Student Loans. Read More Filed Under: fha home loan information , FHA Home Loan Questions , FHA Refinance , First Time Home Buyers Tagged With: 2016 FHA home requirements , 2016 FHA Loan Guidelines , How to get FHA loan 2016