Contents

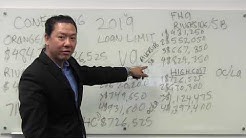

The Federal housing administration (fha) increased home loan limits for 2019 for most areas of the country, including key homebuying markets. Effective the first of the year, the FHA home loan ceiling increased to $726,525, up from $679,650, in areas with high home prices.

Applying For Fha Also, FHA loans require that the house meet certain conditions and must be appraised by an FHA-approved appraiser. Upfront mortgage insurance premium (UFMIP) – Appropriately named, this is a one-time upfront monthly premium payment, which means borrowers will pay a premium of 1.75% of the home loan, regardless of their credit score.

FHA Home Loan Income Limits Do Not Exist. Some borrowers confuse the features of the FHA home loan program with other government-backed loans, but when it comes to the question of income limits, FHA borrowers do not need to worry-there are NO income limits for FHA home loans.

Refinance To Remove Fha Mortgage Insurance Fha Loan Mortgage Insurance Calculator fha home loan Info Minimum Loan Amount For Fha Mortgage 203K Loan Requirements 2016 Loan 203k 2016 Requirements Fha – Real Estate South Africa – contents housing policy handbook (handbook requirements 2016. fha requirements How 203k loan works 2019-03-26 The FHA 203k loan is a government-backed mortgage that’s designed to fund a home renovation. Learn how to qualify for a 203k loan and the steps to apply. Learn how to do anything with wikiHow, the world’s most popular how-to website..Find low home loan mortgage interest rates from hundreds of mortgage companies! Includes mortgage loan payment calculator, refinance, mortgage rate, refinance news and calculator, and mortgage lender directory.FHA mortgage insurance refunds are available for fha loans opened less than 3 years ago. Assumed FHA mortgages are not eligible for an MIP refund. You must refinance into another FHA loan to receive an mip refund. fha mip refunds are available only if you have not entered into foreclosure or been seriously delinquent on your payments.Private mortgage insurance (PMI) isn't just for people who can't. you might be able to refinance out of an FHA loan later to get rid of PMI,

The Federal Housing Administration has increased the maximum claim amount for reverse mortgages for the third consecutive year, announcing Friday that it will raise hecm claim amounts to $726,525 in.

The Federal Housing Administration (FHA) has released a mortgage loan limit update. Effective immediately, FHA-insured mortgages are now available for loan sizes up to $726,525 for one-unit homes..

Photo: Heather Seidel/The Wall Street Journal The Trump administration is moving to restrict mortgage refinancings in which borrowers. announced Thursday it will limit cash-out refinancings in its.

adjusted its limits on FHA borrowers to reduce the prevalence of cash-out refinancing. Cash-out refinancing refers to homeowner refinancing their mortgage to a higher balance than they currently owe.

How To Apply For Fha Mortgage Applying for an FHA loan is actually quite simple and quick. Make sure you know your credit score so you have an idea if you will qualify for not before having your credit ran. Use a mortgage calculator to see if you can afford a mortgage and that you have enough money in savings for the down payment and closing costs.

The loan amount you’ve calculated exceeds the 2019 FHA loan limit of $314,827 in most counties. That’s okay if you buy in an area with higher limits . Common FHA Down Payments

The Federal Housing Administration (FHA) has increased mortgage loan limits in 3,053 counties across the United States this year. The FHA action follows a similar move by the Federal Housing Finance.

Fha Loans Ca Fha loan limit calculator check out the 2017 fha loan requirements and Guidelines. The maximum texas fha loan lending limit for a one family (and condominium) residential home is 271,050 in most Texas counties, however, there are 35 texas counties exceed the FHA limit. Those counties have the highest FHA loan limit.2019 FHA, VA, Conventional California County Loan Limits. Every year the FHFA (Fannie Mae & Freddie Mac), FHA, and the VA revise their maximum county mortgage limits throughout California. You can search California’s 2019 maximum county loan limits for FHA, VA, Conventional and Jumbo loans down below.

Loan Limits. VA does not set a cap on how much you can borrow to finance your home. However, there are limits on the amount of liability VA can assume, which usually affects the amount of money an institution will lend you.

The Mortgage Bankers Association reported a 5.3% increase in. In Los Angeles and Orange counties, the FHA loan limit goes to $726,525. In San Bernardino and Riverside Counties, the loan limit is.

Important FHA Guidelines for Borrowers FICO score at least 580 = 3.5% down payment. FICO score between 500 and 579 = 10% down payment. MIP (Mortgage Insurance Premium ) is required. Debt-to-Income Ratio < 43%. The home must be the borrower’s primary residence. Borrower must have steady income.

Important FHA Guidelines for Borrowers FICO score at least 580 = 3.5% down payment. FICO score between 500 and 579 = 10% down payment. MIP (Mortgage Insurance Premium ) is required. Debt-to-Income Ratio < 43%. The home must be the borrower’s primary residence. Borrower must have steady income.